この記事の概要

The expression “brand-name drugs include an invisible tax” is not commonly used to describe drug prices, but to understand what is being referred to, let us consider the composition of drug prices.

The expression ” brand-name drugs include an invisible tax ” is not commonly used to describe drug prices, but to understand what is being referred to, let us consider the composition of drug prices.

Composition of drug prices

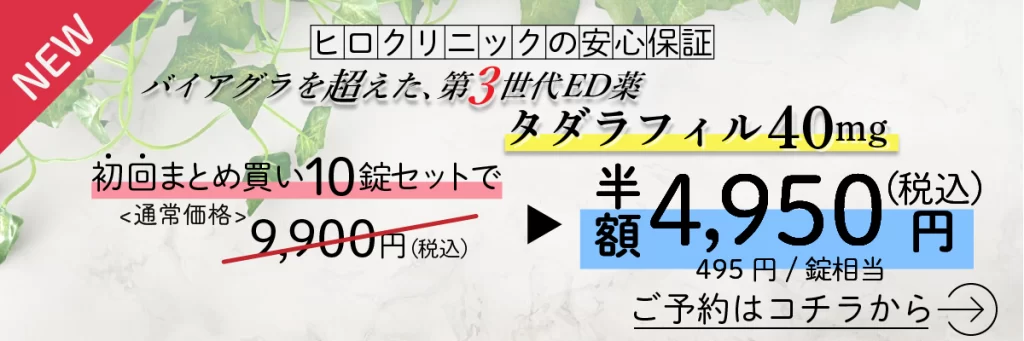

- Research and Development Costs: The price of an original drug includes the enormous research and development costs involved in developing a new drug. Long-term research and rigorous clinical trials are required to bring a new drug to market, and these costs are reflected in the final product price.

- Manufacturing costs: Costs for raw materials, manufacturing processes, quality control, etc. are also included in the product price.

- Post-sale services: The price may include the cost of marketing and sales activities, as well as the provision of information and training to healthcare professionals.

- Taxes: The drug price includes sales tax, which is a “visible tax. There is usually no other direct “tax” reflected in the drug price.

Interpreting “Invisible Taxes”

- An “invisible tax”: one interpretation of this is to think of it as the “cost” of the R&D investment paid when an original drug is brought to market. This is not a direct tax, but a form of development cost borne by the consumer.

- Subsidized pricing: Some countries offer tax incentives or subsidies to encourage pharmaceutical companies to invest in the development of expensive new drugs. These may indirectly affect drug prices, but it is inaccurate to call them “taxes.

Conclusion

The main reason for the high price of brand-name drugs is the need to recover R&D and other costs. While there is no direct “invisible tax” included in the price, it is true that expensive R&D costs are reflected in the price. Some might describe this as an “invisible tax,” but this is not an accurate concept of taxation. If you want to know more about the price of a drug, you may want to consult the publicly available documents of health care economists and pharmaceutical companies.